Overview of Coinbase

Coinbase is one of the world’s leading cryptocurrency exchanges, providing a secure and user-friendly platform for buying, selling, and storing digital assets. Founded in 2012, Coinbase has become a trusted name in the crypto industry, serving millions of users across more than 100 countries. The platform’s mission is to create an open financial system for the world, making cryptocurrencies accessible to everyone.

Coinbase offers two main products: the standard Coinbase platform, designed for beginners seeking a simple way to trade cryptocurrencies, and Coinbase Advanced Trade (formerly Coinbase Pro), which caters to experienced traders with more robust tools and lower fees. In addition to trading, Coinbase provides services like staking, educational resources through the Coinbase Learn program, and a self-custody solution via the Coinbase Wallet.

Get 40% Off 3 Months or a Free Trial Coinbase

Security is a top priority for Coinbase. The platform employs industry-leading security measures, including two-factor authentication (2FA), biometric logins, and offline storage for the majority of user funds. Additionally, Coinbase is fully regulated in the United States and complies with all applicable financial laws, providing users with added peace of mind.

Ease of Use and User Experience

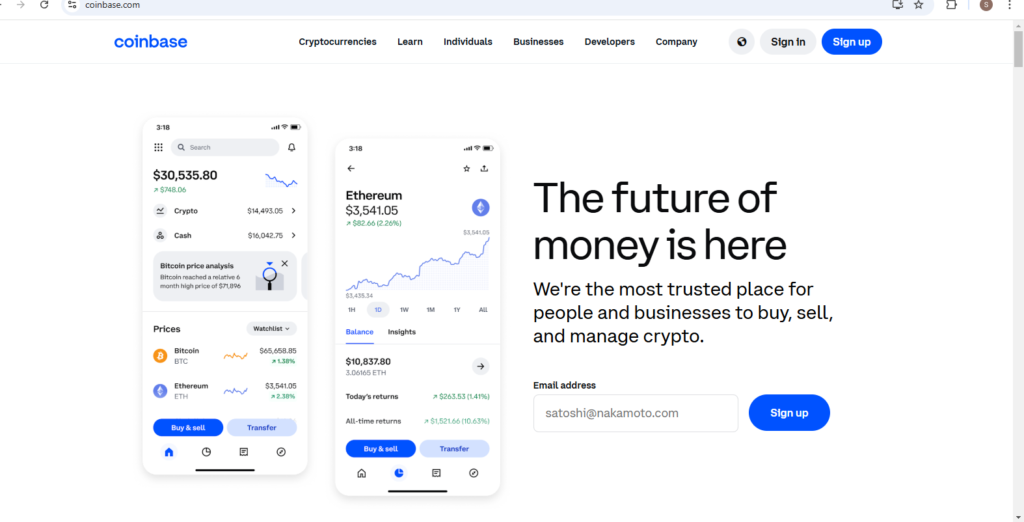

One of the main reasons Coinbase has become a popular choice among cryptocurrency users is its emphasis on ease of use and a seamless user experience. The platform is designed with both beginners and experienced traders in mind, offering an intuitive interface that makes navigating the world of crypto straightforward.

Account setup on Coinbase is simple and fast. Users can create an account, verify their identity, and start trading in just a few steps. The dashboard is clean and provides quick access to essential features like buying, selling, portfolio management, and transaction history.

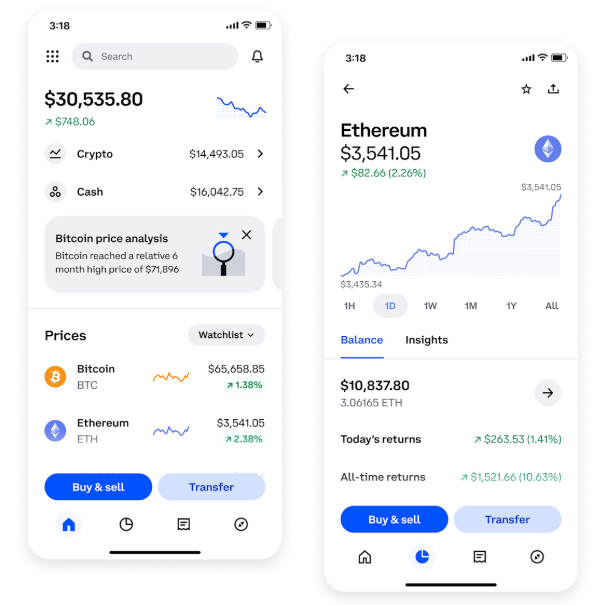

Both the Coinbase website and mobile app are designed for convenience. The mobile app, available for iOS and Android, mirrors the web platform’s functionality, allowing users to trade, monitor prices, and manage assets on the go. Real-time price alerts and push notifications ensure users stay updated with market movements.

For those seeking advanced trading options, Coinbase offers Coinbase Advanced Trade with more comprehensive charts and trading tools while still maintaining a user-friendly design.

Supported Cryptocurrencies

Coinbase offers a wide selection of supported cryptocurrencies, making it a versatile platform for both new and experienced investors. The exchange supports over 200 digital assets, including popular options like Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), and Solana (SOL). This broad range allows users to diversify their portfolios with ease.

Coinbase regularly updates its listings to include emerging cryptocurrencies that meet its strict compliance and security standards. The platform also provides detailed information about each asset, including price history, market data, and project overviews, helping users make informed decisions.

In addition to well-known cryptocurrencies, Coinbase supports stablecoins such as USD Coin (USDC), which are useful for minimizing volatility and facilitating quicker transactions. Users interested in decentralized finance (DeFi) and non-fungible tokens (NFTs) can find tokens relevant to these sectors as well.

For convenience, Coinbase includes a watchlist feature that allows users to track the performance of specific cryptocurrencies. The platform also offers real-time market data and price alerts, helping users stay updated with market trends.

Trading Features and Tools

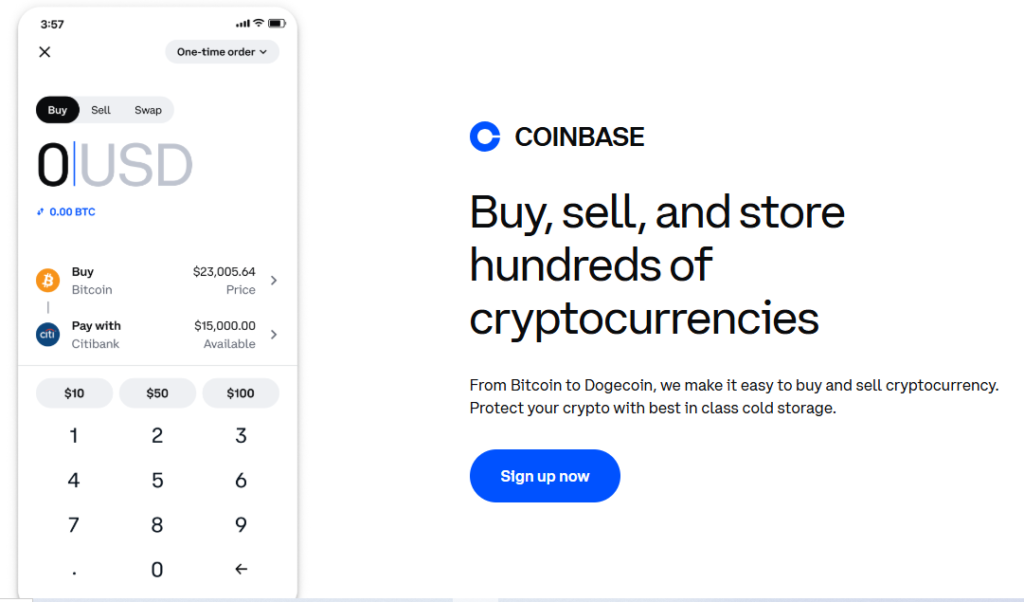

Coinbase offers a variety of trading features and tools designed to meet the needs of both beginners and advanced traders. The platform provides a simple buy, sell, and convert interface, making it easy for newcomers to trade cryptocurrencies without navigating complex options. Transactions can be completed with just a few clicks, and real-time price updates ensure users execute trades at current market rates.

For more experienced users, Coinbase Advanced Trade (formerly Coinbase Pro) offers a range of tools including advanced charting, limit and market orders, and in-depth market analytics. Traders can access customizable charts with various technical indicators to better analyze market trends and make informed decisions.

Coinbase also supports recurring buys, allowing users to automate their investments by scheduling regular purchases of cryptocurrencies. This feature is ideal for those practicing dollar-cost averaging (DCA).

Another notable tool is price alerts, which notify users when specific cryptocurrencies reach predetermined price points. This ensures traders never miss significant market movements.

Additionally, Coinbase provides access to staking services for certain cryptocurrencies, enabling users to earn rewards by participating in network validation processes.

Security Measures

Coinbase places a strong emphasis on security, making it one of the most trusted cryptocurrency platforms in the industry. The company employs a comprehensive set of security measures to protect user accounts, funds, and personal information.

One of the primary security features is two-factor authentication (2FA), which requires users to verify their identity through a secondary device, adding an extra layer of protection against unauthorized access. Additionally, Coinbase supports biometric logins—such as fingerprint and facial recognition—on its mobile app for enhanced account security.

When it comes to safeguarding user funds, Coinbase stores 98% of customer assets in cold storage, meaning they are kept offline to prevent hacking attempts. The remaining assets held online are fully insured against cybersecurity breaches. Furthermore, Coinbase is a publicly traded and regulated company in the United States, complying with all relevant financial regulations, which provides users with added confidence.

To protect sensitive information, Coinbase uses bank-grade encryption and continuous security monitoring. Users can also set withdrawal whitelists to ensure that funds can only be transferred to pre-approved addresses.

Fees and Pricing Structure

Understanding the fees and pricing structure on Coinbase is essential for users looking to trade cryptocurrencies efficiently. Coinbase’s fees vary depending on factors like transaction type, payment method, and the user’s location.

Transaction Fees

Coinbase charges a combination of a spread fee and a Coinbase fee for buy, sell, and convert transactions. The spread fee typically ranges around 0.5%, though it can vary with market fluctuations. The Coinbase fee is calculated based on the transaction amount and payment method used.

Payment Method Fees

- Bank transfers (ACH in the U.S.): Free for deposits; withdrawals may incur minimal fees.

- Credit/debit cards: Higher fees, typically around 3.99%.

- Wire transfers: Flat fees apply depending on the region.

Coinbase Advanced Trade Fees

For users seeking lower fees, Coinbase Advanced Trade offers a maker-taker fee model:

- Maker fees: 0.00% to 0.40% depending on monthly trading volume.

- Taker fees: 0.05% to 0.60%, encouraging liquidity in the market.

Other Fees

- Crypto withdrawals: Network fees apply, varying by cryptocurrency.

- Staking fees: Coinbase charges a commission on staking rewards, typically around 25%.

Being aware of these fees can help users make cost-effective trading decisions on Coinbase.

Regulation and Compliance

Coinbase is known for its strong commitment to regulation and compliance, making it one of the most trusted cryptocurrency exchanges globally. As a publicly traded company listed on the NASDAQ under the ticker symbol COIN, Coinbase adheres to strict regulatory standards and financial reporting requirements.

In the United States, Coinbase is registered as a Money Services Business (MSB) with the Financial Crimes Enforcement Network (FinCEN) and complies with the Bank Secrecy Act (BSA) and Anti-Money Laundering (AML) regulations. These measures ensure that the platform actively monitors and prevents illegal activities such as money laundering and fraud.

Globally, Coinbase works with regulators in the regions where it operates. In the European Union, the platform complies with the Fifth Anti-Money Laundering Directive (5AMLD), while in the UK, it is registered with the Financial Conduct Authority (FCA). This focus on regulatory adherence helps Coinbase maintain operational licenses in over 100 countries.

To enhance transparency, Coinbase conducts regular security audits and provides users with clear information on privacy policies and compliance procedures. By meeting local and international regulations, Coinbase ensures a secure and trustworthy environment for its users.

Customer Support and Service Quality

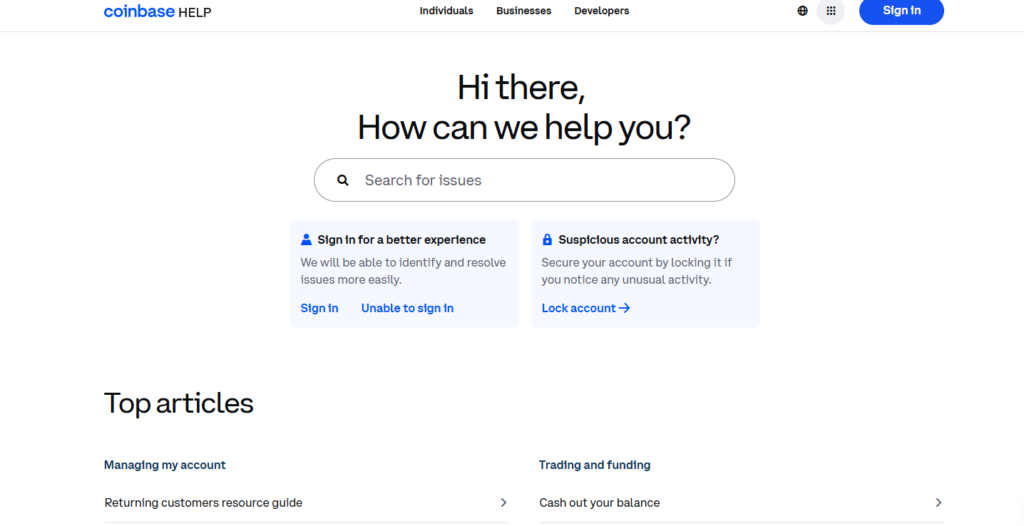

Coinbase places a strong emphasis on providing reliable customer support and service quality to ensure a positive user experience. The platform offers multiple support channels, catering to both beginners and advanced users seeking assistance with account management, transactions, and technical issues.

Support Channels

- Help Center: The Coinbase Help Center is a comprehensive resource with articles, guides, and FAQs covering common questions and troubleshooting tips.

- Live Chat: Users can access live chat support for real-time assistance with account or transaction-related concerns.

- Email Support: For less urgent inquiries, Coinbase provides responsive email support, typically resolving issues within 24-48 hours.

- Phone Support: Coinbase offers phone support for account recovery and urgent matters, providing an additional layer of assistance.

Service Quality

Coinbase focuses on delivering timely and effective solutions to its users. The platform continually updates its support resources to address evolving customer needs. Additionally, users can monitor the Coinbase Status Page for real-time updates on system performance and potential service interruptions.

The platform also values user feedback, using it to enhance service quality and improve future support experiences.

Coinbase Wallet vs. Exchange

Coinbase offers two distinct products for cryptocurrency users: the Coinbase Wallet and the Coinbase Exchange. While both serve essential roles in the crypto ecosystem, they cater to different user needs. Understanding the differences between them can help users decide which option best suits their goals.

Coinbase Exchange

The Coinbase Exchange is a centralized platform where users can buy, sell, and trade cryptocurrencies. It’s designed for convenience, especially for beginners looking for an easy way to enter the crypto market. Funds held on the exchange are custodial, meaning Coinbase manages the private keys and provides security for user assets. This setup simplifies transactions and account recovery but limits direct control over funds.

Coinbase Wallet

The Coinbase Wallet is a self-custody cryptocurrency wallet, giving users full control of their private keys and assets. Unlike the exchange, the wallet is a separate application that supports a wide range of cryptocurrencies, decentralized apps (dApps), and non-fungible tokens (NFTs). Users can send, receive, and store crypto independently, which is ideal for those who prioritize decentralization and direct asset ownership.

Key Differences:

- Control: Coinbase Exchange is custodial; Coinbase Wallet is non-custodial.

- Functionality: The exchange focuses on buying and trading, while the wallet emphasizes storage and decentralized app interaction.

- Security: With the wallet, users are responsible for their private keys, adding security but requiring more vigilance.

- Accessibility: The exchange is more user-friendly for beginners, while the wallet appeals to advanced users.

Payment Methods Supported

Coinbase offers a variety of payment methods to make buying, selling, and trading cryptocurrencies accessible to users worldwide. The platform supports multiple options, allowing users to choose the method that best suits their needs for convenience, speed, and cost-effectiveness.

Supported Payment Methods:

- Bank Transfers (ACH and SEPA):

- ACH (U.S. users): Free deposits with minimal withdrawal fees.

- SEPA (European users): Low-cost transfers with quick processing times.

- Ideal for users making larger transactions with lower fees.

- Credit and Debit Cards:

- Allows for instant cryptocurrency purchases.

- Carries higher fees (around 3.99%) but offers quick processing.

- Best for users seeking fast transactions without waiting for bank processing times.

- Wire Transfers:

- Suitable for high-volume transactions.

- Fees vary depending on the user’s location and bank policies.

- PayPal (Available in Select Regions):

- Users can fund accounts, withdraw fiat, and purchase cryptocurrencies.

- Offers faster withdrawals, but availability depends on the country.

- Apple Pay and Google Pay:

- Enables quick, seamless purchases through the Coinbase mobile app.

- Offers convenience for users preferring mobile-based payments.

Factors to Consider:

- Fees: Credit cards and PayPal often come with higher transaction costs compared to bank transfers.

- Speed: While credit cards and PayPal provide instant purchases, bank transfers may take 1-3 business days.

- Availability: Payment methods can vary depending on the user’s country and local regulations.

Pros and Cons of Using Coinbase

When choosing a cryptocurrency platform, it’s essential to weigh the pros and cons of using Coinbase. As one of the most popular exchanges globally, Coinbase offers a variety of features, but it’s not without its drawbacks.

Pros of Using Coinbase:

- User-Friendly Interface:

- Coinbase’s platform is designed for beginners, making buying and selling cryptocurrencies simple and intuitive.

- Wide Range of Supported Cryptocurrencies:

- Offers access to over 200 digital assets, allowing users to diversify their portfolios easily.

- High Security Standards:

- Features like two-factor authentication (2FA), cold storage, and insurance coverage protect user funds and information.

- Regulatory Compliance:

- As a publicly traded company, Coinbase follows strict regulations, providing a trustworthy environment for users.

- Advanced Trading Tools:

- Offers Coinbase Advanced Trade for experienced users, featuring detailed charts, limit orders, and lower fees.

- Multiple Payment Methods:

- Supports various payment options, including bank transfers, credit/debit cards, PayPal, and mobile wallets.

- Educational Resources:

- Coinbase Earn allows users to learn about cryptocurrencies and earn small amounts of crypto for participating.

Cons of Using Coinbase:

- Higher Fees Compared to Competitors:

- Standard transaction fees can be expensive, especially for credit card purchases.

- Limited Customer Support:

- Some users report delays in response times, particularly during periods of high demand.

- Custodial Nature of Exchange Accounts:

- Users don’t control their private keys unless they use the Coinbase Wallet.

- Geographical Restrictions:

- Certain services and cryptocurrencies may not be available in all countries.

- Complex Fee Structure:

- Fee transparency can be confusing, especially for new users.

- Occasional Service Downtime:

- During periods of high market volatility, Coinbase has experienced temporary outages.